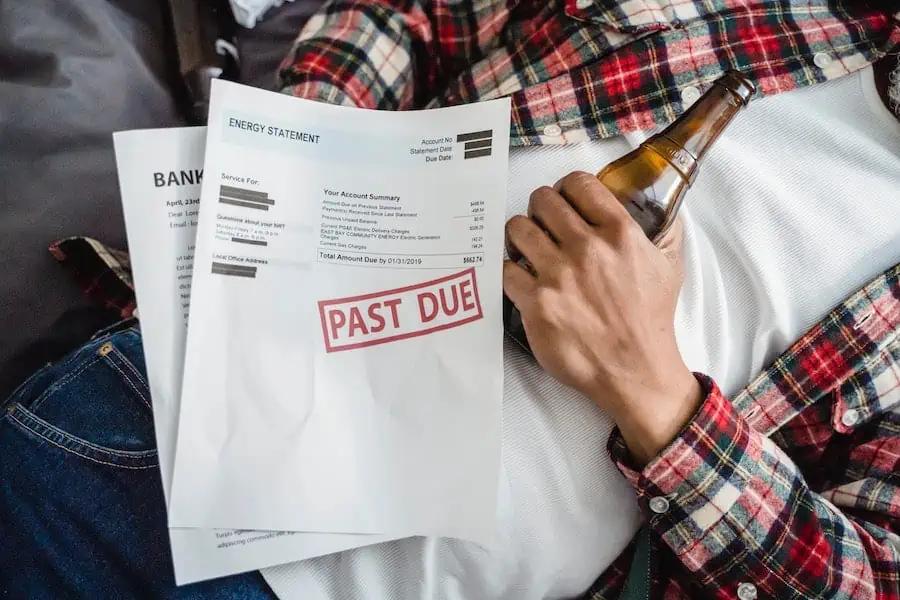

As an entrepreneur, you’ve risked it all for your business. Whether you open a store, restaurant, or offer a service, you take out loans to get the capital you need to build and keep your business running.

Maybe you got a cash loan from the bank or the U.S. Small Business Administration. But in the end, if your vision never gets off the ground, and you find yourself sinking further into debt. As such, you may be inclined to file for bankruptcy.

What Is Bankruptcy?

Bankruptcy is a legal process that allows an individual or a business to get rid of debt or restructure it. If you are facing overwhelming debt in Louisiana, it is essential to understand how to file for bankruptcy in Louisiana, a legal process that allows individuals or businesses to get rid of debt or restructure it based on their unique circumstances. It will depend on your circumstances and the type of bankruptcy you file.

There are three different options for filing for bankruptcy. Chapter 7 wipes out all unsecured debt, such as unsecured loans or credit card debt. While Chapter 7 bankruptcy may make sense for a person with a lot of debt and little income or assets, it may not be the best choice for a business.

Chapter 7 bankruptcy for a business is called liquidation. This is because the federal officer overseeing the case will close the business and liquidate its assets to pay off the debts.

Chapter 13 is only for individuals and not businesses. It may be a good fit for those that can’t file for Chapter 7. However, you can file for Chapter 11 bankruptcy if your small business is a corporation.

Which Type of Bankruptcy Should You File?

If you’re wondering which type of bankruptcy you should file for, it will depend on your circumstances. Small business owners who are not incorporated are personally liable for their business debts. This means they would file either Chapter 7 or Chapter 13.

Chapter 7 is best for sole proprietors or freelancers whose business is not legally separate. If you’re a solopreneur with a home you own, you can choose Chapter 7 or Chapter 13 and likely get to keep your home. If you have too much equity, you may find Chapter 13 is a better option.

If you have incorporated your small business, Chapter 11 may be a good fit. It is ideal for corporations that generate income but not enough to cover expenses. In this instance, you and your creditors would come to an agreement on a plan for reorganization and repayment.

What Are the Downsides to Filing for Bankruptcy as a Small Business?

While filing for bankruptcy isn’t something you should be ashamed of, it does have some downsides. For starters, you and your small business will come under the scrutiny of any trustees and creditors.

Additionally, filing for bankruptcy may not completely wipe out all of your debts. You may need to create a schedule of payments. All bankruptcies stay on your credit report for the next ten years. Although you can repair your credit with hard work over the next few years, it’s something to consider.

It’s important to understand the positives and negatives of filing for bankruptcy as an entrepreneur. Discussing this with a bankruptcy lawyer can help you understand whether it’s the right move for your business.

How Much Does It Cost to File for Bankruptcy in Chicago?

The current fees for filing for bankruptcy in Chicago are $338 for Chapter 7, $1,738 for Chapter 11, and $313 for Chapter 13. These are not the only fees you will need to pay, as there are payment installment options and fee waivers that may be applicable in your situation.

If there are additional actions related to your case, you may end up with more fees. You’ll also be required to take a credit counseling course and a financial management course which can range in price from $10 to $50 per session.

While you can file for bankruptcy on your own, it will go much more smoothly with the help of an attorney. Bankruptcy lawyers can help you navigate this complex and confusing process to avoid making costly mistakes. You should also plan on the fees in the cost of filing for bankruptcy, though many attorneys will offer options to make payment easier.

Most bankruptcy lawyers also offer a free initial consultation. It’s not a bad idea to find out if this may be a good option for you. Visit this website to find out more about filing for bankruptcy for your small business.